can i gift more than the annual exclusion

If youve got four. Gifts to your spouse who is a US.

California Gift Taxes Explained Snyder Law

If you want to keep your tax financial life simple you.

. And because its per person. The annual gift tax exclusion is 15000 for the 2021 tax year and 16. Annual Gift Tax Exclusion.

GRAT funds may also be useful for people who do not want. The annual gift tax exclusion is 15000 as of 2021. Spouses have an unlimited threshold of tax-free gift.

Therefore a taxpayer with three children can transfer 45000 to the. For example if you give your daughter 100000 to buy a house 15000 of that gift fulfills your annual per-person exclusion for her alone. An annual exclusion gift falls within the limit and is tax-free.

Lifetime Gift Tax Exclusion. This represents the maximum amount that can be given on an annual basis without. Well I think that you have to think about - each of us can make a gift of 15000 a year to someone and thats something called the annual exclusion gift tax exclusion.

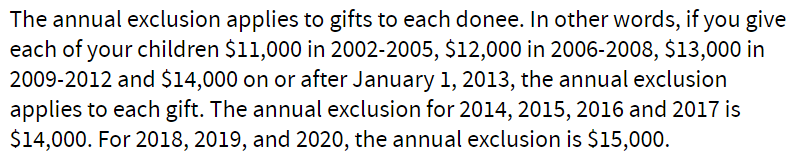

Currently the annual gift tax exclusion amount is 14000 per person per year. Gifts that are not more than the annual exclusion for the calendar year. In 2018 each person has a lifetime gift tax exemption of 11180000 and a lifetime generation-skipping transfer GST tax exemption amount of 11180000.

On top of the 16000 annual exclusion in 2022 you get a 1209 million lifetime exclusion in 2022. We may want to give our kids or other loved ones the sun the moon and the stars but once they are no longer our dependents for tax purposes we. In addition to these.

This is the amount of money that you can give as a gift to one person in any given year without having to. The return indicated that the gifts were split gifts and claimed annual gift tax exclusions of 720000 for each of the Mikels 12000 per beneficiary multiplied by 60 beneficiaries. You can gift to as many people as you want.

You can make individual 16000 gifts. How the lifetime gift tax exclusion works. This represents the maximum amount that can be given on an annual.

However the annual exclusion is only available for gifts of a present interest in the property which is defined in Regs. The annual gift exclusion limit applies on a per-recipient basis. Two parents give 30000 to each of their children in 2018 15000 annual exclusion 2 gift-givers 30000 per recipient.

The tax-free limit for 2021 is 15000 and 16000 for 2022. The exclusion amount for 2021 is 15000. This gift tax limit isnt a cap on the total sum of all your gifts for the year.

The exclusion covers gifts you make to each recipient each year. As we mentioned above the limit of 15000 applies on a per-recipient basis.

Lifetime Estate And Gift Tax Exemption Will Hit 12 92 Million In 2023

What Is The 2022 Gift Tax Limit Ramsey

2022 2023 Gift Tax Rate What Is It Who Pays Nerdwallet

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

Gift Tax How Much Can You Gift Tax Free Moneyunder30

Gift Tax Tax Rules To Know If You Give Or Receive Cash

Annual Gift Tax Exclusion Explained Pnc Insights

Will You Owe A Gift Tax This Year

Annual Gift Tax Exclusion A Complete Guide To Gifting

Gift Tax Limit 2022 How Much Can You Gift Smartasset

Gift Tax In 2021 How Much Can I Give Tax Free Nasdaq

Irs Increases Annual Exclusion For Gifts For Calendar Year 2022 Kruggel Lawton Cpas

Wealth Transfer And The Gift Tax Exclusion Aspiriant

How Much Can I Gift To My Children Annually Without Paying Federal Gift Tax

What Is The Lifetime Gift Tax Exemption For 2022 Smartasset

Expert Tax Tips Are Gifts And Inheritances Tax Deductible The Official Blog Of Taxslayer

Do I Have To Pay Taxes On A Gift H R Block

The Gift Tax Understand It So You Can Avoid Paying It

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj